KEEP IT SIMPLE and STUPID

Bollinger Bands | Reversal Bar | Vertex indicator

Dave, with his strong IT background, was looking at hundreds of indicators, he kept one: the Vertex.

Many months later, buried in research, Dave developed the KISS strategy as a reliable entry technique to trade across asset-classes and timeframes.

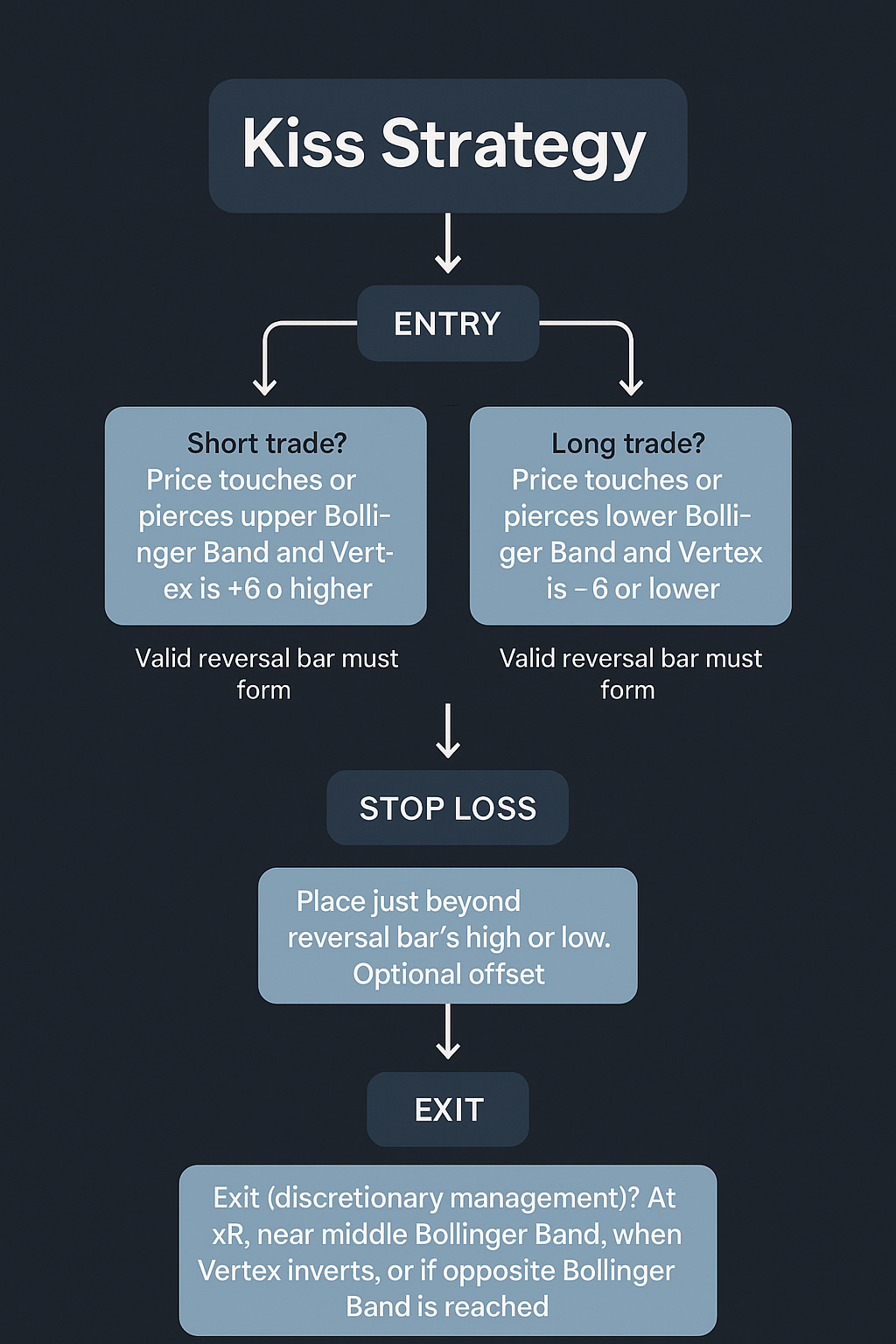

HOW TO TRADE THE KISS STRATEGY

Entry, Stop LOSS & Exit

Examples

Bullish

- Price trades at lower Bollinger Band

- Vertex <= -6

- A reversal bar has formed

- Entry on close of reversal bar

- Exit descretionary

Bearish

- Price trades at upper Bollinger Band

- Vertex >= +6

- A reversal bar has formed

- Entry on close of reversal bar

- Exit discretionary

What to avoid

- Bollinger Squeeze

- Reversal bar is a mere doji with no discernable body

- Vertex not 6 / -6

- Price trading alongside one part of the Bollinger Band

Join The Xchange

Join the KISS strategy channel on The Xchange (Discord) to engage with traders and discuss conversations, ideas, and strategies.